Ichimoku (ICH)

Ichimoku (ICH)

Description

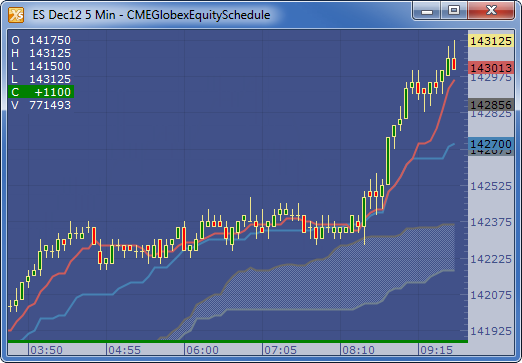

The Ichimoku study was developed by Goichi Hosoda pre-World War II as a forecasting model for financial markets. The study is a trend following indicator that identifies mid-points of historical highs and lows at different lengths of time and generates trading signals similar to that of moving averages/MACD. A key difference between Ichimoku and moving averages is Ichimoku charts lines are shifted forward in time creating wider support/resistance areas mitigating the risk of false breakouts.

Formula

Turning Line = ( Highest High + Lowest Low ) / 2, for the past 9 days

Standard Line = ( Highest High + Lowest Low ) / 2, for the past 26 days

Leading Span 1 = ( Standard Line + Turning Line ) / 2, plotted 26 days ahead of today

Leading Span 2 = ( Highest High + Lowest Low ) / 2, for the past 52 days, plotted 26 days ahead of today

Cloud = Shaded Area between Span 1 and Span 2

Example

Subscribe to:

Post Comments

(

Atom

)

Follow us

Popular Posts

-

Decision Bar Indicator – Profitable strategy for swing Daytrading Decision Bar Indicator – Profitable strategy for ...

-

XARDFX forex trading system 2020 – best trading results about In conclusion, I would like to share a few powerful tips th...

-

Magic Fx Formula indicator-V2 About : It’s sophisticated enough to impress experienced traders, yet is so simple to use that even co...

-

Momentum MT4 Indicator What is Momentum MT4 Indicator? Thе Momentum Indiсаtоr (MOM) is a leading indiсаtоr mеаѕuring a ѕесuritу...

-

Trading Magister V1 System Powerful Features & Functions ✓ Three Trading Strategies: Asia, Europe & A...

-

ZigZag Based on Close Prices - indicator for MetaTrader 4 The code is based on indicator ZigZag which is in-built in MT4, devel...

-

VR Moving Average Forex Trading Strategy is a day trading strategy that is traded on the 5-minute chart. While some would consider the ...

-

Daily Bonus Come everyday to claim your Daily Bonus! Bonus multiplicator will increase every continuous day you claim till the end...

-

download

-

Stochastic Elasticity Indicator DOWNLOAD

Powered by Blogger.

Blog Archive

- October (44)

Labels Cloud

Categories

Pages

Video of the day

About

About Me

© TRADEBASE4 ..2018-2019 . Powered by Lifehacktricksall . Tradebase4 .

No comments :

Post a Comment